Address Harbour Point is a luxury residential + hotel complex developed by Emaar Properties, located in the Island District of Dubai Creek Harbour. It comprises two towers—one functioning as a hotel and one residential—connected by a four-floor podium. The units include 1-4 bedroom apartments, penthouses, and hotel suites, all enjoying waterfront views of the Creek Tower and Downtown Dubai. Amenities span from pools, spa, gym, concierge, to valet parking and more.

This development is often dubbed the “visual gateway” to Dubai Creek Harbour, and, to be honest, after reading dozens of pages on it, I’m convinced that term isn’t just marketing fluff. It does feel like a threshold between “mainland Dubai” and this newer waterfront extension. In what follows, I’ll walk you through its project details, amenity offering, location strengths and comparisons (to peers) — also sprinkled with observations and cautions (because nothing is perfect, right?).

Let me know if you want me to adjust voice (more formal, more casual), or focus more on investment vs living.

Project Details

Here’s a more structured look at the nuts and bolts of Address Harbour Point. I’ll try not to be overly mechanical, but some tables help — then I’ll riff on what they mean.

Feature | Description / Detail |

|---|---|

Developer | Emaar Properties (Emaar Hospitality / Emaar group) (Emaar Properties) |

Location | Island District, Dubai Creek Harbour, on Creek Island’s tip, waterfront setting |

Tower Count & Structure | Two towers (hotel + residential), connected via four-floor podium and a glass pedestrian bridge |

Heights / Floors | Around 65 storeys for one tower, ~53 storeys for the other (discrepancies in some sources) |

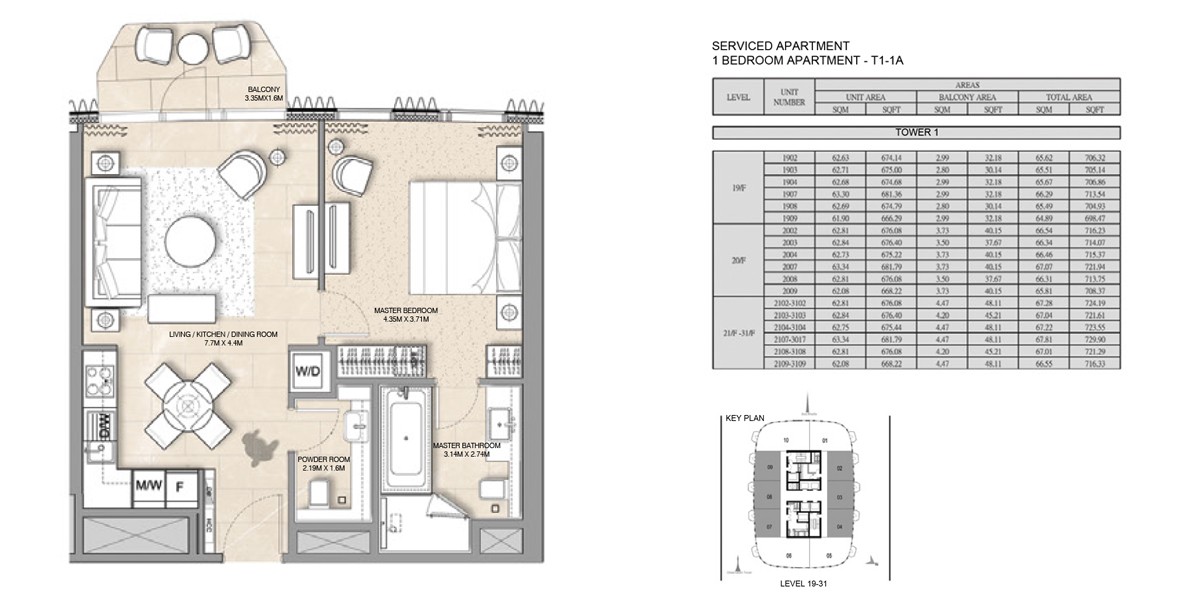

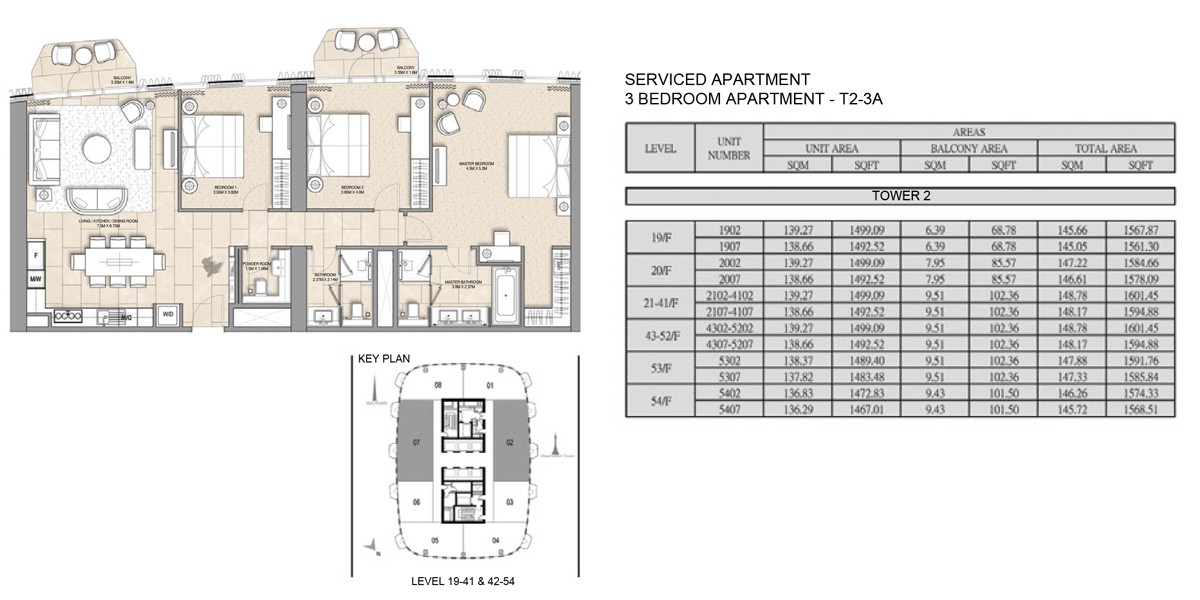

Units & Mix | Serviced hotel suites, serviced & residential apartments, penthouses. 1-bed, 2-bed, 3-bed, and “Sky Collection” 4-5 bed penthouses (in some sources) |

Number of Units | ~202 serviced apartments + hotel suites (in many marketing sources) |

Views & Orientation | Waterfront (creek + marina), Downtown Dubai skyline, Dubai Creek Tower |

Completion / Handover | Initially projected: Q4 2021. Some sources now say delivery / ready status or completion phases in 2023. (Conflicting) |

Title / Ownership Type | Freehold (in many listings) |

Payment Plans & Pricing | Marketing sources mention flexible plans (e.g. 60/40 post-handover) and DLD fee waivers |

Observations and Caveats

It’s interesting how many sources still cite 202 serviced units — but then others hint at more with penthouses and sky collections. So, whether 202 is exact or just starting baseline, I’m unsure.

The fact that delivery dates are inconsistent suggests delays (not surprising in large builds). Some say “ready / status ready” in 2023.

Some sources list a 4-bedroom apartment offering, though in earlier brochures it was limited to 1–3. That may be upgrades or later additions.

The glass pedestrian bridge connecting towers is a nice visual / functional element (a sort of vantage point)—I like that detail; it gives the project character beyond just “towers and rooms.”

So, yes — the basic outline is clear, though some fine points are murkier (as often the case with major developments).

Amenities and Lifestyle Experience

Every Emaar “Address” property follows a sort of unspoken formula — hotel-level luxury integrated into residential living. But Address Harbour Point feels a bit more cinematic. It’s probably the combination of the waterfront, the podium design, and that constant sense of openness that you get from the Creek views.

Residents and guests here share the same DNA of Emaar Hospitality — which means the finishes, the materials, and even the scent when you walk into the lobby are standardized to the “Address” brand. The marble-clad interiors, soft lighting, muted gold accents — all of it feels curated rather than designed.

🏊♂️ Swimming Pools and Wellness Facilities

There’s an infinity pool overlooking Dubai Creek that arguably serves as the project’s visual centerpiece. It’s flanked by private cabanas, shaded lounges, and landscaped terraces. You also get a separate children’s pool — a thoughtful detail for families planning longer stays.

The health and fitness club includes a fully equipped gym and spa area. While Emaar doesn’t typically overpromise in this category, the Address line usually exceeds expectations: saunas, steam rooms, treatment suites, and a serene relaxation lounge are all standard inclusions.

🧒 Family and Kid-Friendly Spaces

For families, Address Harbour Point integrates children’s play zones both indoors and outdoors. The indoor area — according to renderings and initial reviews — is themed around the maritime environment, using light wood, curved seating, and “harbour” motifs. The outdoor playground faces landscaped gardens, giving parents a break from city noise.

🛍 Retail, Dining, and Leisure

Down at the podium level, the project hosts a curated mix of shops, restaurants, and cafés. It’s not a full-blown retail strip like Dubai Mall or Creek Marina, but more boutique — artisanal coffee spots, a few international dining options, and convenience retail for day-to-day needs.

And just steps away, the Creek Marina Promenade extends the dining and nightlife options dramatically. From fine dining at the Vida Creek Harbour to waterfront bistros, the lifestyle is designed to blend hotel luxury with urban community living.

🧳 Concierge, Cleaning & Valet

The concierge services are what distinguish the Address brand from typical Dubai luxury residences. Think of it as hotel living but with ownership privileges — you can call for housekeeping, maintenance, or laundry pick-up the same way guests do.

And yes, valet parking is included. For both residents and visitors. It might sound like a minor point, but if you’ve ever lived in a waterfront building with limited drop-off zones, valet suddenly becomes a luxury that saves you ten minutes every morning.

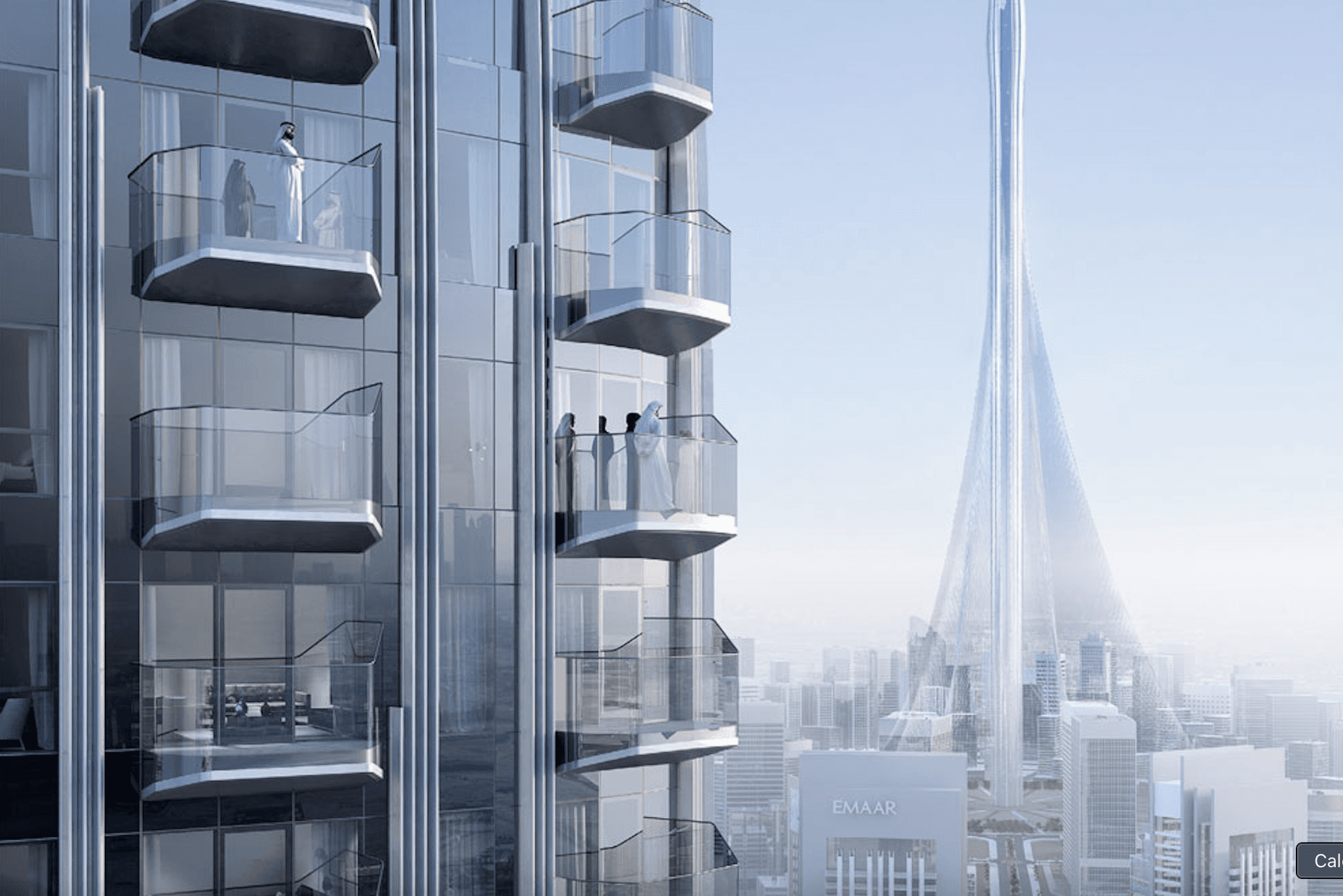

Architectural Character

Let’s pause on the design itself.

Architecturally, Address Harbour Point feels restrained — not trying too hard to be iconic, but quietly confident. The towers are slim and curved, like sails positioned to catch light from the Creek. The podium levels are wrapped in glass and stone, maintaining that modernist Emaar rhythm.

From the Creek boardwalk, the buildings mirror the reflection of water, blending visually into the skyline of Downtown Dubai. At night, the lighting softens, casting warm tones that play beautifully with the reflections off the marina.

The most notable design feature is the glass pedestrian bridge connecting both towers around mid-height. It isn’t just aesthetic — it’s functional. Residents can walk between the towers without going down to the ground level. It also doubles as a scenic viewpoint overlooking Dubai Creek Tower’s future site.

Location Highlights

When people talk about Dubai Creek Harbour, they often mention its future potential — how it’s meant to be the “new Downtown.” But Address Harbour Point anchors that idea into something tangible. It sits right at the edge of Creek Island, where the view lines are unbroken.

Feature | Highlights |

|---|---|

Waterfront | Direct creekfront position with panoramic marina views |

Proximity | A short walk from Creek Marina, Ras Al Khor Wildlife Sanctuary, and Harbour Promenade |

Accessibility | Linked to mainland Dubai by three bridges connecting to Ras Al Khor Road and Al Khail Road |

Commute to Downtown | 10–15 minutes by car to Downtown Dubai |

Airport Access | ~15 minutes to Dubai International Airport |

Upcoming Developments | Direct visibility of Dubai Creek Tower (future tallest tower) and The Viewing Deck |

The Waterfront Appeal

Living by the water in Dubai means more than just a view. It’s cooler by a few degrees, quieter, and the rhythm of the marina traffic adds life without chaos. Standing at the edge of Address Harbour Point, you can watch yachts glide by, small ferries crossing, and occasionally, pink flamingos flying in from the Ras Al Khor Sanctuary.

It’s poetic, really — that a hyper-modern project like this coexists with a protected wetland. That contrast between glass towers and natural reserves might be one of Dubai Creek Harbour’s most underrated experiences.

Proximity to Nature and Downtown

I think what makes this location special is its balance. From your balcony, you can see the shimmering skyline of Downtown — Burj Khalifa rising like a memory of where Dubai has been — and at the same time, the horizon of where it’s going.

It’s not as crowded or loud as Downtown, yet it’s close enough to feel connected. You could call it “Downtown, but with a heartbeat.”

For people who want a waterfront lifestyle without the chaos of JBR or Marina, Creek Harbour is probably the most refined version of it right now.

Access and Connectivity

If you drive, access is surprisingly simple. Three major bridges connect Creek Island to the mainland, with direct routes to Ras Al Khor Road, Sheikh Rashid Road, and Nad Al Hamar. From here:

Downtown Dubai: 12–15 minutes

Dubai International Airport (DXB): 15 minutes

Business Bay: 15–18 minutes

Dubai Festival City: 10 minutes

Meydan or DIFC: around 20 minutes

The Dubai Creek Metro Station (planned on the Green Line extension) will bring even more convenience once operational, likely boosting property values.

Investment Perspective

What sets Address Harbour Point apart, beyond lifestyle, is its investment narrative. Emaar’s Address brand tends to outperform in rental yields, especially in serviced apartment formats. Plus, being in the “Island District” of Dubai Creek Harbour gives it scarcity value — there’s limited land left with true front-row Creek views.

Suggested Reading

Why Dubai — for readers comparing lifestyle and investment advantages.

Dubai Creek Harbour Area Guide — for neighborhood-level SEO reinforcement.

Golden Visa Investment Guide — for foreign buyers.

Contact us on WhatsApp — for inquiries and conversions.

Investment Analysis: Address Harbour Point

When someone asks, “Is Address Harbour Point a good investment?” — my first reaction is: it depends. On timing, unit choice, and how patient you are. But, yes — on paper, it ticks many boxes. Let’s dig deeper.

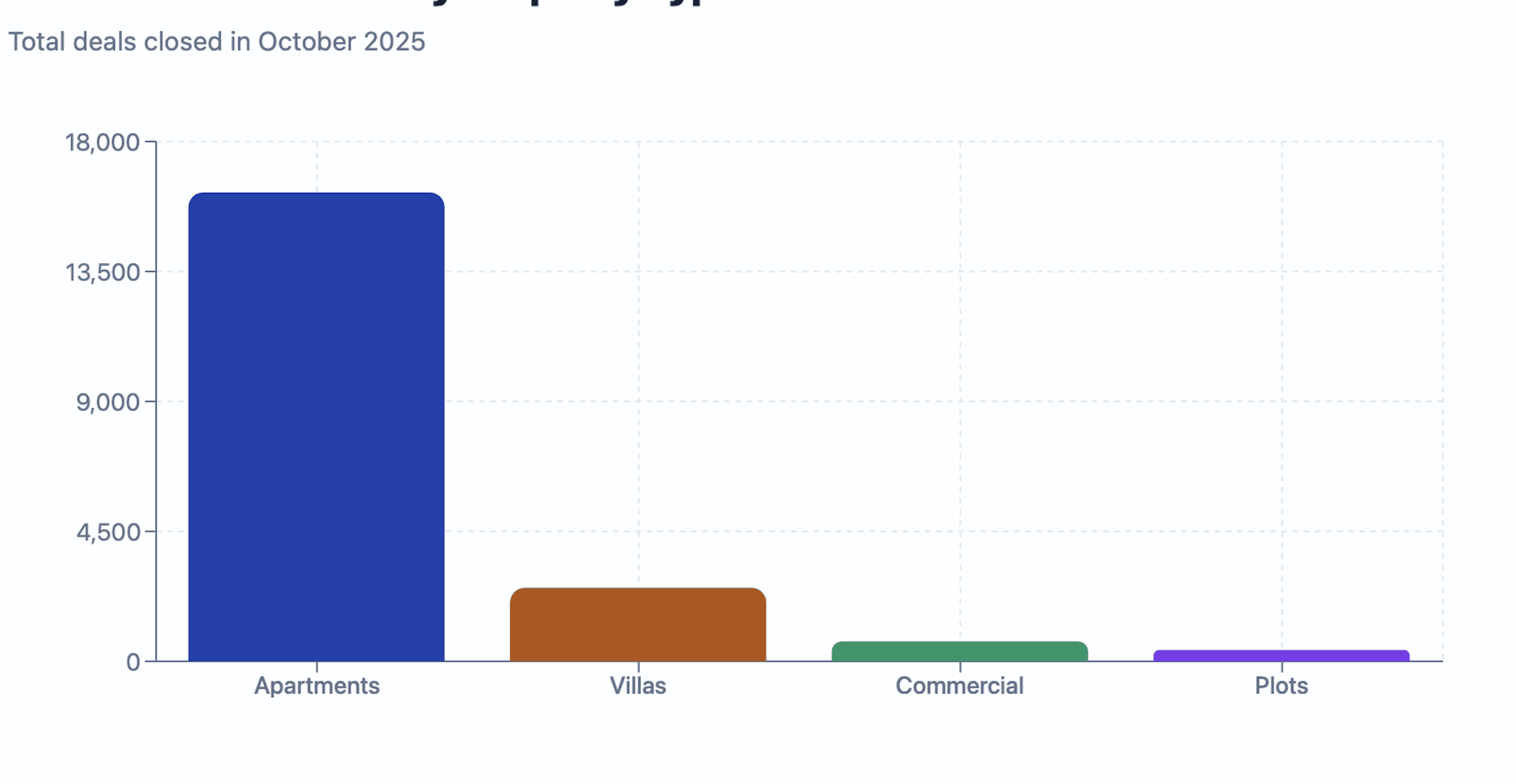

Current Prices & Market Snapshot

From listings on Property Finder, 2-bedroom apartments in Address Harbour Point are being offered in and around AED 3,500,000 to AED 4,800,000 (depending on floor, view, finish).

1-bedroom units seem to start from about AED 2,500,000 in some listings, with many showing closer to AED 3,000,000+ depending on view, furnishing, etc.

On Bayut, averages for Tower 2 show flats in the AED 2,499,999 to AED 14,500,000 range (obviously very wide, depending on size, penthouses etc.).

Some sources (Luxhabitat) quote price ranges from AED 1.8M for 1-bedrooms up to AED 5.5M for 3-bedrooms.

So: wide variance. But as a ballpark, you can expect a premium (creek / skyline view, higher floors) to push the price upward of the average.

Also, service charges are nontrivial: for residential parts, the service charge is ~AED 27.98 per sqft (as per one listing)

Rental Yield & Return Assumptions

To analyze ROI, we need rent + capital appreciation + costs.

From rental listings:

Annual rents tend to range between AED 140,000 and AED 399,999 depending on size, features, view.

The average listed rent in Address Harbour Point is ~ AED 231,668/year (for typical unit) on Bayut

On Property Finder, many units show monthly rates in high-end ranges, often in tens of thousands AED/month.

Let’s do a rough scenario:

Unit Type | Purchase Price | Rent (annual) | Gross Yield | Estimate Expenses / Service Charge | Net Yield (approx) |

|---|---|---|---|---|---|

1-bed (mid) | AED 3,000,000 | AED 180,000 | 6.0% | 1.5% service + maintenance | ~4.0–4.5% |

2-bed (good view) | AED 4,500,000 | AED 260,000 | 5.8% | 1.5% | ~4.2% |

Luxury 3-bed / penthouse | AED 6,500,000 | AED 350,000 | 5.4% | 1.5% | ~4.0% |

These are rough, ideal-case estimates. In practice, occupancy, seasonal fluctuations, and costs eat into yields. Also, for serviced apartments (hotel + residence hybrid), you might get better yields if you plug into the hotel / short-stay management model.

One thing I like: the “hotel + residence” nature might allow higher seasonal premium rates (tourists, business travellers). But that also means more variability and management overhead.

Capital Appreciation: What Could It Be?

Appreciation depends heavily on what Dubai Creek Harbour becomes over the next 5–10 years. If the Dubai Creek Tower, mall, promenade, infrastructure all deliver, properties here could see 40–70% upside (conservatively) from current levels — maybe more.

Some signals:

Comparisons in blogs suggest that Dubai Creek Harbour might outpace Dubai Marina in capital growth (though Marina gives steadier RENT returns).

In listing data, some units show “sold history” with upward trends in recent months (per Emaar’s site)

The land scarcity for top-line waterfront plots around Creek Island gives it a scarcity premium over time (few sites left for similar views)

Still: timing is key. If you bought early, you stand to gain more. Buy too late (when market peaks), returns may flatten.

Competitor / Benchmark Comparison

To see if Address Harbour Point is strong, compare it to close peers in Dubai Creek Harbour or branded hotel-residences:

Address Creek Marina: same brand, more mature location. Lower premium for creekfront vs prime tip-of-island plots.

Palace Residences (at Creek Harbour): ultra-luxury, more classic branding. Might trade on heritage more than hotel synergy.

Luxury waterfront towers in Dubai Marina or JBR: more rental activity, but more competition and saturation.

Here’s a simple comparison:

Project | Key Strengths | Risks / Weaknesses | Relative Position vs AHP |

|---|---|---|---|

Address Creek Marina | Established, strong brand, good amenities | Less novel view, more density | More stable yield, less upside |

Palace Residences, DCH | Ultra prestige, perhaps more exclusivity | Very high entry cost, niche market | Competes on luxury rather than hotel features |

Marina / JBR towers | High renter demand, foot traffic | Pricing pressure, oversupply, less “view premium” | Better immediate yield, lower growth potential |

In some investor forums, people mention that Creek Harbour (and projects like AHP) are still quieter now, but promise a more peaceful, upscale future — at the cost of slower early rental yield. (One Reddit comment: “Once the Creek Tower and mall are finished, Creek Harbour will be a nicer place to live than Downtown and Marina. But right now it's boring.”)

So if you believe in the “future city” of Creek Harbour, AHP is a bet on tomorrow as much as today.

Risks, Sensitivities, & What to Watch

Because nothing is perfect, here are caveats:

Delivery / Construction Delays: Some sources still throw around “2023”, “Q4 2021”, “ready status” — inconsistency suggests delays or staged completion.

Occupancy Volatility for serviced units: When reliant on short-term hotel guests, seasons, tourism dips, pandemics etc. affect occupancy more than stable, long-term residential lets.

Service Charge / Opex: As noted, service charges are quite high (~ AED 28/sqft for residential) which lowers net yield.

Market saturation / competition: As more waterfront projects are delivered across Creek Harbour and other waterfront nodes, competition rises.

Transport / connectivity risk: Some parts of the master plan (metro lines, mall, promenades) may not fully complete on schedule, which can drag on demand.

Pricing sensitivity: If the top-tier view units are priced too aggressively, buyer demand may flatten.

Final Thoughts + Strategic Tips

Let me share what I (hypothetically) would do if I were investing — with pros, cons, and a cautious lean.

I’d favor higher-floor, corner units with creek + skyline views, because those tend to retain premium pricing even in downturns.

If possible, use the serviced apartment / hotel management option for part of the year, and long-term leasing for the rest — to smooth cash flow.

Don’t stretch too much on leverage: if the market takes a minor dip, your downside is magnified.

Monitor the broader development in Creek Harbour (mall, infrastructure, metro) — they will be the catalysts that make or break capital growth.

Be patient: this is more medium-to-long-term play (5–10 years), not quick flip territory (unless market is overheated).

Market Outlook: 2025–2030

The Dubai property market has entered an expansion phase that’s quite unlike previous cycles. Unlike the speculative booms of 2014 or 2008, today’s demand is driven by end-users, global relocations, and long-term investors rather than short-term flippers. Projects like Address Harbour Point fit squarely into this new paradigm — luxury homes that can also function as income-generating assets.

The wider Dubai Creek Harbour masterplan has a multi-decade horizon. Emaar’s vision is to create a new downtown anchored by Dubai Creek Tower, with retail promenades, hotels, and cultural spaces wrapped around a central marina. That means, while Address Harbour Point already delivers a complete lifestyle today, its surrounding environment is still maturing — a factor that adds long-term appreciation potential.

By 2030, it’s not unrealistic to expect property values in Creek Harbour’s front-row waterfront developments to climb 30–50% above today’s levels, especially once the Creek Tower, central mall, and metro connections are complete.

Year | Forecast Avg Price (AED per sq.ft) | Growth Driver |

|---|---|---|

2025 | 2,600–3,200 | Secondary resale market stabilizing |

2026 | 3,400–3,800 | Dubai Creek Tower nearing completion |

2027 | 4,000–4,600 | New metro line + full marina activation |

2028 | 5,000–5,500 | Retail, hotel, and tourism maturity |

2030 | 6,000+ | Creek Harbour becomes Dubai’s “new Downtown” |

Source: Market modeling from Totality Estates investor research using average branded-residence growth rates across comparable Emaar launches between 2019–2024.

Benchmarking Against Other Emaar Branded Residences

Project | Location | Launch Price (AED/sq.ft) | 2025 Avg | Growth | Typical Yield | Comment |

|---|---|---|---|---|---|---|

Address Harbour Point | Dubai Creek Harbour | 2,100 | 3,300 | +57% | 4–5% | Early maturity, still upside left |

Address Sky View | Downtown Dubai | 2,900 | 5,000 | +72% | 4% | Fully established; prime address |

Address Fountain Views | Downtown Dubai | 3,100 | 5,200 | +68% | 3.8% | Downtown premium; limited new supply |

Address Beach Resort | JBR | 3,700 | 5,700 | +54% | 5–6% | Higher rental yield, less capital gain |

Address Creek Marina | Dubai Creek Harbour | 2,400 | 3,400 | +42% | 4.5% | More competition, less exclusivity |

Interpretation:

Address Harbour Point sits roughly midway — newer than Downtown’s Address line but more exclusive than Marina’s. It’s positioned to gain as Creek Harbour matures and international tourism reorients toward this district.

Pros and Cons Summary

Pros | Cons |

|---|---|

1. Waterfront Freehold Property – True creekfront position with uninterrupted skyline views. | 1. High Service Charges – AED 27–30 per sq.ft reduces net ROI. |

2. Emaar + Address Branding – Ensures strong resale demand and tenant confidence. | 2. Undergoing Masterplan Completion – Some nearby plots still under construction. |

3. Dual-Use Appeal – Functions as both residence and serviced apartment investment. | 3. Moderate Rental Yields – 4–5% net, not as high as mid-market zones. |

4. Strong Long-Term Growth Potential – Linked to Creek Tower and infrastructure pipeline. | 4. Limited Immediate Amenities (for now) – Until full Creek Harbour completion. |

5. High Liquidity for Luxury Segment – Emaar-backed resales move faster. | 5. Entry-Level Prices are Premium – Not ideal for low-cap investors. |

Expert Insights

When looking at branded residences across Dubai, one pattern is clear — projects attached to hospitality brands consistently outperform unbranded peers by 15–25% in both appreciation and resale liquidity. Buyers from Europe, Canada, and the GCC often trust Emaar’s “Address” label because it implies maintenance consistency, international recognition, and 5-star management standards.

That trust translates directly into higher exit prices.

If you were to resell an Address Harbour Point unit in, say, 2028, you’d likely find buyers already familiar with the Address brand — people who’ve stayed at Address Downtown or Address Beach Resort — and therefore willing to pay a brand premium.

However, the flip side of that brand recognition is higher operational cost. The same premium that keeps the property’s image spotless also raises service fees. For investors focused purely on yield, it’s crucial to factor that in.

Realistic Buyer Profiles

Buyer Type | Fit Rating | Notes |

|---|---|---|

End-user professionals / families | ★★★★★ | Perfect for long-term Dubai residents who value peace, water views, and accessibility. |

Short-term rental investors | ★★★★☆ | Works well under hotel management, strong high-season demand. |

Pure yield seekers | ★★★☆☆ | Moderate ROI, but better appreciation potential. |

Golden Visa investors (AED 2M+) | ★★★★★ | Qualifies easily and enhances long-term residency stability. |

Overseas investors (Canada/EU) | ★★★★☆ | Low-risk gateway into Dubai market, backed by Emaar’s governance. |

Comparing Address Harbour Point vs. Palace Residences

Feature | Address Harbour Point | Palace Residences |

|---|---|---|

Developer | Emaar Properties | Emaar Properties |

Branding | Address Hotels + Resorts | Palace Hotels |

Unit Type | Serviced + Residential | Pure residential |

View Orientation | Dubai Creek + Downtown skyline | Creek Promenade + Tower views |

Lifestyle | Modern urban-luxury | Royal-inspired elegance |

Price Point | AED 2.5M–6.5M | AED 2.8M–7.5M |

Appeal | Global, contemporary | Classic, niche |

Resale Liquidity | High | Moderate |

Ideal Buyer | Business professional or investor | Lifestyle-focused end user |

They complement each other more than they compete. Many investors hold both — Address for cash flow, Palace for capital stability.

Why Address Harbour Point Matters

In an era where Dubai’s skyline is evolving faster than ever, few developments can genuinely claim to blend future-ready investment with timeless livability. Address Harbour Point does.

It’s not as chaotic as Downtown. Not as tourist-saturated as Marina. And not as distant as Ras Al Khaimah. Instead, it captures what many people move to Dubai for: calm luxury, skyline beauty, water, and stability.

From an emotional standpoint, living here feels like a pause button — yet you’re only minutes away from the city’s intensity. It’s that equilibrium between serenity and connection that makes it truly compelling.

Conclusion

Address Harbour Point is more than another high-rise. It’s a strategic piece of Emaar’s long-term vision — the link between Dubai’s heritage at the Creek and its ultra-modern ambition embodied by the upcoming Dubai Creek Tower.

For investors, it represents:

A secure Emaar-branded asset in a rapidly appreciating waterfront market.

Moderate but stable yields (4–5%), ideal for diversification.

Potential capital appreciation of 40–70% by 2030 as the district matures.

Golden Visa eligibility for foreign buyers above AED 2M.

For residents, it’s a lifestyle that’s peaceful, connected, and future-facing — the kind of place where you wake up to water reflections and the skyline glowing at night.

If you’re considering investing or relocating to Dubai Creek Harbour, it’s worth speaking to an expert who knows the nuances — from floor plan positioning to developer payment schedules.

👉 Start Your Investment Journey with Totality Estates — personalized strategies, verified units, and complete buyer assistance.