The Dubai real estate market continued its upward trajectory in July 2024, showcasing impressive growth across multiple property sectors. As the city solidifies its position as a global real estate hotspot, the market's performance in July offers valuable insights into the trends driving this growth. From soaring transaction volumes to rising property values, here’s a detailed look at how Dubai’s real estate market fared in July 2024.

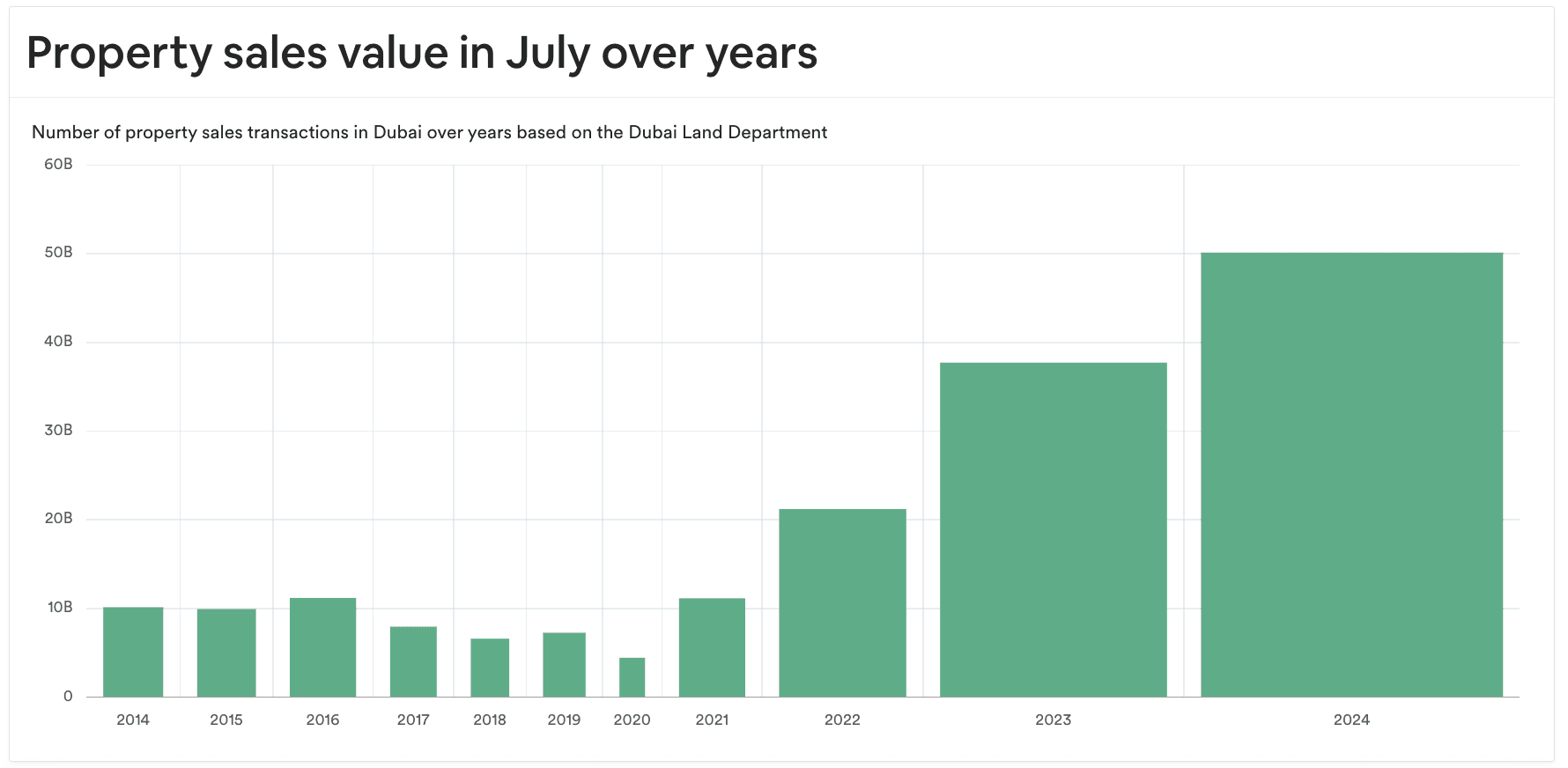

The Dubai real estate market saw significant growth in July 2024. There was a 45.5% increase in total sales volume compared to the same period in 2023, reaching 16,247 transactions. The total sales value climbed to AED 50.1 billion, marking a 32.9% increase year-on-year. This reflects the continued investor confidence in Dubai’s real estate market.

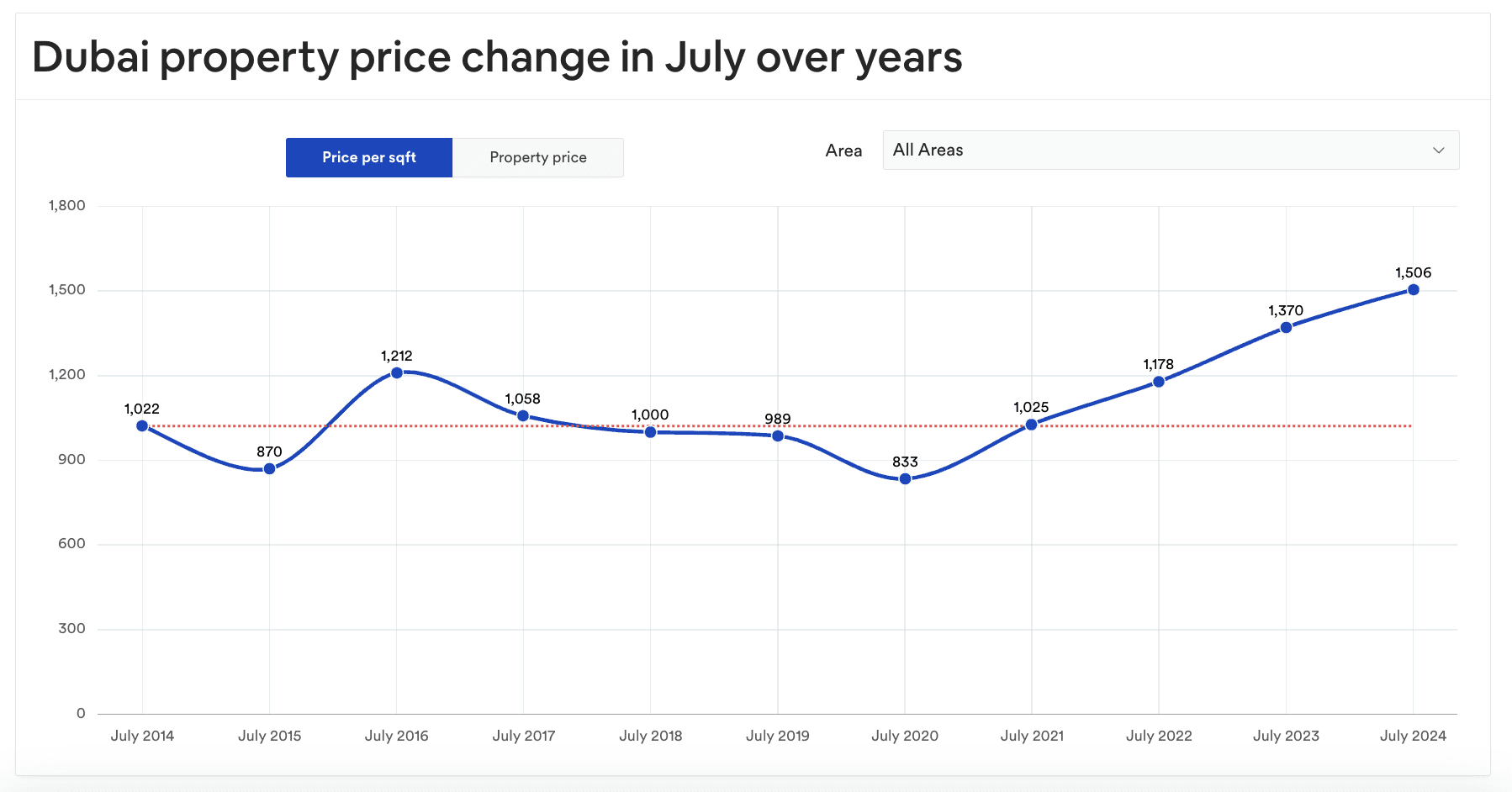

The average price per square foot rose by 9.8% year-on-year to AED 1,504, highlighting increased demand for quality real estate in prime locations. In July 2024, apartments remained the dominant force in the market, with 12,651 transactions, representing a 61.9% increase compared to July 2023.

The sales value for apartments soared to AED 22.6 billion. The average price of an apartment in Dubai reached AED 1.3 million, indicating a growing appetite for residential units, particularly in well-connected and sought-after areas.

There is a Resilient Demand for Villas

In July 2024, there was a high demand for villas, with 2,363 transactions, a 9.9% increase from the previous year. The total sales value for villas reached AED 14.5 billion, indicating the sustained popularity of spacious, high-end living spaces among buyers.

The average price for villas saw a significant increase of 20.6% to AED 4 million. This notable price surge reflects the premium that buyers are willing to pay for villas, especially in exclusive neighborhoods known for their luxury and privacy.

Commercial Properties and Plots: Mixed Performance

The commercial property segment experienced positive growth, with 387 transactions recorded in July 2024, marking a 27.7% increase compared to the same period in 2023. The total sales value of commercial properties reached AED AED 870.6 million, with the average price per commercial property rising by 36.8% to AED 1.4 million. This growth indicates a strong demand for commercial spaces in key business districts as Dubai continues to attract companies and entrepreneurs.

On the other hand, the market for plots presented a more mixed picture. Although the number of plot transactions declined by 6.2% to 846, the total sales value of plots reached AED 12.2 billion. Interestingly, the average price per plot surged by a remarkable 96.8% to AED 5.3 million, suggesting that high-value plots in prime locations were a focal point for investors in July.

There are Shifting Rental Market Dynamics

In July 2024, the rental market in Dubai exhibited diverse trends. Apartment rents surged by 15.4%, reaching an average annual rent of AED 75,000. Similarly, villa rents increased by 15.6%, with an average annual rent of AED 185,000. These increments indicate a burgeoning demand for residential rentals, particularly in prime and family-friendly neighbourhoods. On the other hand, the commercial rental market experienced a notable 23.6% decline, with average rents plummeting to AED 42,000 annually. This decrease may signify evolving dynamics in the commercial sector, potentially attributed to an oversupply of office spaces or changing business requirements post-pandemic.

The Mortgage Market Reflects Buyer Confidence

In July 2024, there was a significant increase in mortgage activity in Dubai, with 4,092 mortgage transactions recorded, marking a 74.4% increase compared to July 2023. The total value of these transactions was AED 14.1 billion, showing a 46.7% increase year-on-year. This growth in the mortgage market reflects strong buyer confidence and favorable lending conditions, contributing to the expansion of the real estate market.

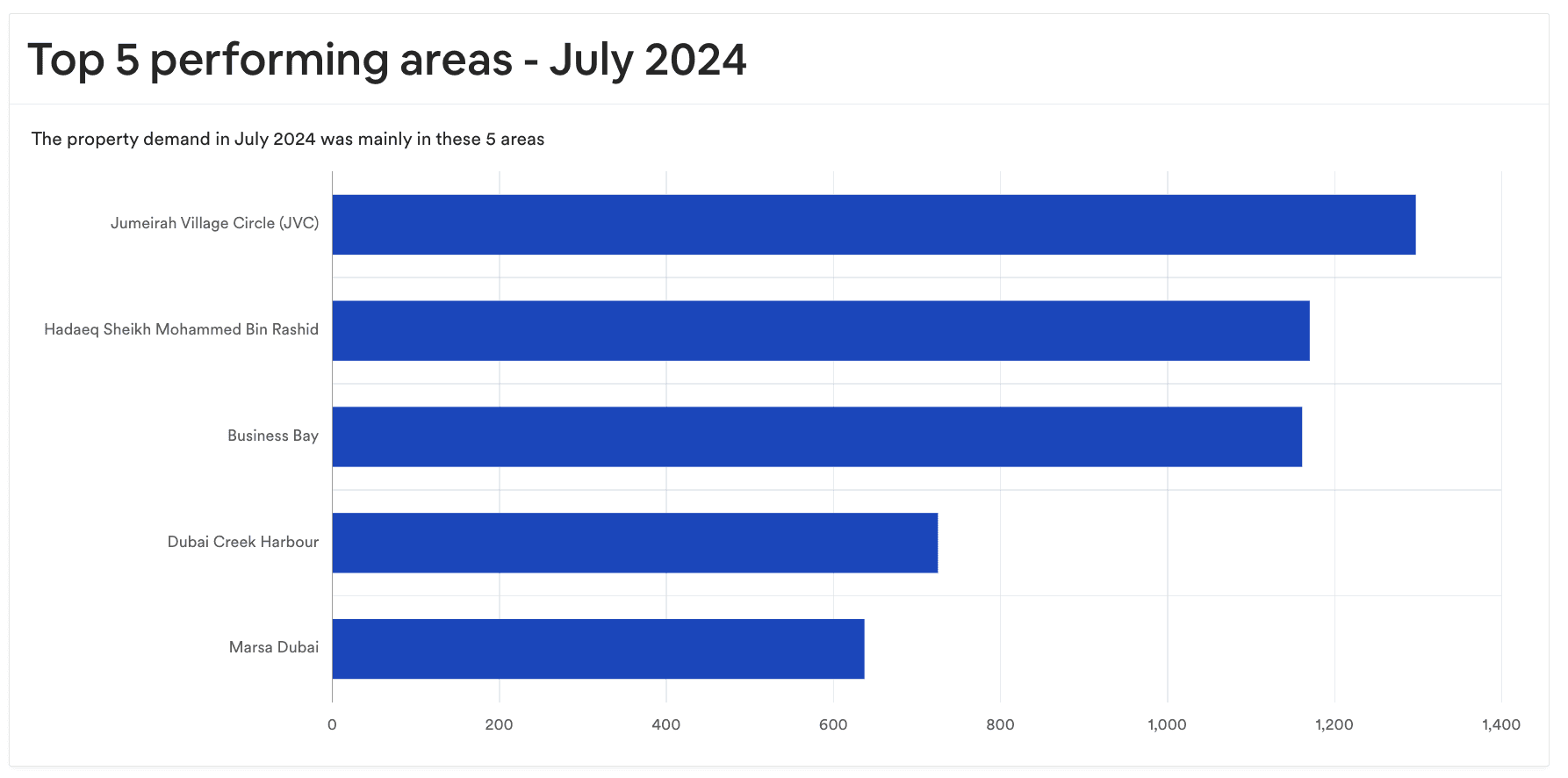

Key Areas Driving Market Growth

In July 2024, several areas in Dubai were major contributors to the market's growth. Jumeirah Village Circle (JVC), known for its affordable housing options and vibrant community, experienced a high volume of transactions. Hadaeq Sheikh Mohammed Bin Rashid, featuring luxury villas and expansive green spaces, attracted significant investment, particularly in the high-end segment

Business Bay continued to thrive as a major commercial and residential hub, with strong demand for both office spaces and residential units. Dubai Creek Harbour, an emerging waterfront development, saw increased interest, especially in off-plan properties, driven by its strategic location and promising future developments. Lastly, Marsa Dubai remained a top choice for luxury waterfront properties, drawing high-net-worth individuals seeking premium residences.

High-Value Transactions Highlight Market’s Luxury Appeal

In July 2024, the luxury real estate market witnessed several high-value transactions. The priciest apartment sold was at Orla Infinity by Omniyat in Palm Jumeirah, fetching AED 77 million. Other notable high-value apartment sales included units at Crystals in Silicon Oasis (AED 69 million) and Baccarat Residence T1, Burj Khalifa (AED 51 million).

In the villa market, the most expensive transaction was for a villa at Eome in Palm Jumeirah, which sold for AED 103 million. Significant villa sales also took place at Zaya Zuha Island in The World (AED 61 million) and Karl Lagerfeld Villas by Taraf in Wadi Al Safa 3 (AED 25 million).

The Best-Selling Projects of July 2024

In the off-plan apartment market, Palace Residences in Dubai Hills Estate was the top seller, with 915 units sold, totaling AED 2.3 billion in sales. Additionally, Arlo and Bayz 101 by Danube also performed well, making significant contributions to the overall market activity.

When it comes to off-plan villas, Greenway and Golf Lane were among the top sellers, with substantial sales volumes and values. For ready properties, Remraam and Nad Al Sheba Gardens Phase 5 were the leading projects in the apartments and villas categories, respectively, showcasing their popularity among buyers seeking completed properties.

A Promising Outlook for Dubai Real Estate

July 2024 was an outstanding month for Dubai's real estate market, marked by strong growth in all property segments. The notable rise in sales volume and value, along with increasing property prices and high demand in important areas, demonstrates the market's strength and attractiveness. As Dubai continues to draw investors from across the globe, the outlook for the rest of the year is optimistic, with the city set to strengthen its position as a leading global real estate destination.

* Data provided by dxbinteract.com

Name | Volume | Value |

Off-Plan Apartments | ||

|---|---|---|

Palace Residences, Dubai Hills Estate | 915 | AED 2.3 billion |

Arlo | 362 | AED 1 billion |

Bayz 101 by Danube | 305 | AED 668.2 million |

Cove Living Residence by Imtiaz | 207 | AED 154 million |

10 Oxford by Iman | 189 | AED 180.4 million |

Off-Plan Villas | ||

Greenway | 114 | AED 406.6 million |

Golf Lane | 84 | AED 397.4 million |

Nad Al Sheba Gardens Phase 4 | 75 | AED 341.6 million |

Reportage Village | 66 | AED 89.7 million |

Nad Al Sheba Gardens Phase 5 | 50 | AED 240.9 million |

Ready Apartments | ||

Remraam | 149 | AED 88.5 million |

Azizi Pearl | 109 | AED 91 million |

Topaz Avenue | 44 | AED 59.4 million |

Crystals | 41 | AED 59.9 million |

Downtown Views II | 38 | AED 127.8 million |

Ready Villas | ||

Nad Al Sheba Gardens Phase 5 | 32 | AED 503.9 million |

The Fields at D11 - MBRMC | 21 | AED 74.1 million |

La Rosa 6 | 21 | AED 60.8 million |

Arabian Ranches III - Ruba | 18 | AED 53.2 million |

The Valley - Eden | 17 | AED 44.5 million |