Some of the best luxury branded residences in Dubai include the Bvlgari Residences on Jumeirah Bay, The Royal Atlantis Residences on Palm Jumeirah, Armani Residences in the Burj Khalifa, and Dorchester Collection projects such as One at Palm Jumeirah and ORLA Infinity. Other highly sought-after choices are Six Senses Residences on the Palm and the new Bugatti Residences in Business Bay.

If you're reading this, you probably already know a few of those names. Maybe you've walked through the lobby of Atlantis The Royal and quietly thought, "I could live like this". Or you've seen Bugatti Residences on Instagram and wondered whether the private car elevators are just a gimmick or actually part of a serious investment story.

In 30 seconds: where Dubai's best branded residences really stand out

- Status: Dubai now has more branded residences (built + in pipeline) than almost any city globally; the segment has grown over 120% in the last five years alone.

- Safety of brand: Buyers lean on the brand Bvlgari, Bugatti, Dorchester, Six Senses, Mercedes-Benz”not just for aesthetics, but as a kind of quality filter and long-term resale anchor.

- Lifestyle: Think hotel-level services (concierge, housekeeping, spa, valet) blended with very private residential layouts and, often, wellness or beach-club-style amenities.

- Investment: In the right project, you're betting on three things at once: Dubai's macro story, an ultra-prime micro-location, and the global brand's halo effect.

Along the way, I'll reference other deep dives for example, if you want to pair this with a more numbers-driven off-plan piece, you can read the Dubai off-plan: goldmine or death trap? article on Totality Real Estate.

Let's just demystify the term before jumping into the best of list.

Branded residences are homes developed in partnership with a world-recognized brand usually a luxury hotel chain (Six Senses, One&Only, Ritz-Carlton), a fashion house (Armani, Bvlgari, Karl Lagerfeld), or an automotive icon (Bugatti, Mercedes-Benz).

From an owner's point of view, three things usually change compared with a normal luxury apartment:

1. Design language

2. Service stack

- 24/7 concierge

- Hotel-style housekeeping and maintenance options

- Spa, wellness, valet, F&B curated to the brand's standards

- Six Senses on the Palm, for instance, wraps residences around a 60,000 sqft wellness club with longevity clinic, bio-hacking rooms, spa, squash court and workspaces.

This part is harder to quantify but very real. In practice, branded residences:

If you're coming from traditional buy-to-let or more value communities, it can feel slightly irrational at first. Why pay double per square foot for an address and a logo? The honest answer is that branded residences are less about maximum yield and more about a very specific mix of lifestyle, legacy and capital preservation.

We'll talk about returns later. For now, let's map the landscape.

Here's a quick overview of the projects most people mean when they say the best branded residences in Dubai today.

Project | Location | Brand / Operator | Typical property types | Headline appeal | Broad buyer profile |

Bvlgari Residences | Jumeirah Bay Island | Bvlgari / Meraas | Ultra-prime apartments & villas | Private seahorse-shaped island, yacht club, extreme scarcity | UHNWIs wanting maximum privacy and a resort feel |

The Royal Atlantis Residences | Palm Jumeirah crescent | Atlantis / Kerzner | 2-5BR apartments, sky courts, penthouses | Iconic stacked design, sky pool, 90m high bridge, fine-dining cluster | Global elite wanting resort energy + views |

Armani Residences | Burj Khalifa, Downtown | Armani | 1-2BR branded suites | First branded residence in Dubai, direct Dubai Mall / Fountain access | Fashion-driven buyers, pied-à-terre seekers |

One at Palm Jumeirah (Dorchester Collection) | Palm Jumeirah trunk | Dorchester / Omniyat | 3-7BR residences | 94 homes only, 360° sea and skyline views, private berths | End-users wanting beach + services without a hotel crowd |

ORLA / ORLA Infinity (Dorchester Collection) | Palm Jumeirah crescent | Dorchester / Omniyat | Bespoke apartments and 20 ultra-limited duplexes | Resort-style living, ultra-low density, pinnacle Palm address | |

Six Senses Residences The Palm | Palm Jumeirah | Six Senses / Select Group | Sky villas, penthouses, beachfront villas | Wellness-first, huge private club, strong sustainability positioning | |

Bugatti Residences by Binghatti | Business Bay | Bugatti | 2-4BR mansions + Sky Mansion penthouses | Automotive-inspired tower, private car lifts, Riviera-themed podium |

Bvlgari Residences, Jumeirah Bay: the quietest power move

- Scale and density: Everything here is intentionally under-built. Blocks are low, units are wide, and outdoor areas are generous. The absence of a typical Dubai forest of towers is not a bug; it's the feature.

- Price psychology: Recent 2-bed resale listings frequently sit in the mid-20M to 30M+ AED range, with larger unique layouts climbing far beyond that. At this level, buyers are not comparing yields; they're comparing neighbors and anonymity. Bvlgari tends to attract very low-profile UHNWIs who already own homes across multiple global cities.

- Lifestyle and access: Residents benefit from:

Bvlgari Marina & Yacht Club membership

Resort-level F&B and spa

Easy access into Jumeirah and Downtown (Dubai Mall is roughly a 15-20 minute drive, traffic depending).

The Royal Atlantis Residences, Palm Jumeirah: ultra-luxury with theatre

Where Bvlgari is about understatement, The Royal Atlantis Residences is the opposite: it's deliberately theatrical.

Perched on the outer crescent of Palm Jumeirah and rising to around 185 meters ”roughly twice the height of the original Atlantis the project's stacked, offset blocks have become one of Dubai's most recognizable silhouettes.

Why people fall for it:

From an investment standpoint, Royal Atlantis sits in an interesting middle space: it's clearly global trophy stock, but because it doubles as Dubai's big hospitality icon, it also benefits from steady demand from buyers who want a lock-up-and-leave second (or third) home with reliable services and rental potential during periods of non-use.

Armani Residences, Burj Khalifa: where the trend began

What makes it still relevant today?

As an investment, Armani Residences is more of an iconic city-centre base than a high-yield machine. But if you want a branded pied-à-terre that puts you in the absolute heart of Downtown, it's hard to argue with.

One at Palm Jumeirah

One at Palm Jumeirah is often described as one of the most refined residential buildings in Dubai, branded and serviced by Dorchester Collection. It's located on the trunk of the Palm, with a direct waterfront position and some of the cleanest Dubai Marina and open-sea views you can get.

A few reasons serious buyers keep circling back to it:

Pricing here has consistently placed it at the upper end of Dubai's residential spectrum, especially for large simplex and duplex layouts. It's not the place you buy to optimize yield; it's where you buy if you want Palm living without the resort crowds, and you're happy to pay for that peace.

A few things that stand out:

For investors, the Dorchester-branded Palm assets usually slot into a portfolio as stabilizing anchors: extremely expensive per square foot, hard to replace, and appealing to a very specific global buyer segment.

Six Senses Residences The Palm is one of the clearest examples of how branded residences are evolving beyond hotel services plus logo.

Here, the brand promise is essentially: live inside a destination wellness resort, permanently.

The project combines branded residences with a full Six Senses hotel and an unusually extensive wellness club. We're talking about a 60,000+ sqft wellness and lifestyle zone with spa, longevity-focused treatments, bio-hacking facilities, workspaces, and a very deliberate slow-living aesthetic.

What that translates to in everyday life:

From an investment standpoint, Six Senses tends to appeal to buyers who:

If you like the Six Senses thesis but want to compare it with more numbers-first plays higher-yield apartments in emerging areas it's useful to put it side by side with more analytical guides like the Most affordable areas to buy in Dubai piece on Totality.

Now to one of the newer names on the list, and one you specifically asked to include.

W Residences Dubai Harbour is a triple-tower branded complex by Arada in partnership with Marriott's W Hotels brand, located in Dubai Harbour a prime, waterfront district between Dubai Marina and Palm Jumeirah.

At a glance:

What makes W Harbour interesting in the context of best luxury branded residences in Dubai is the tone of the brand. Where Bvlgari or Dorchester whisper, W is much more unapologetically social:

In investment terms, W Residences Dubai Harbour sits at the intersection of three powerful drivers:

If you're evaluating it as an off-plan investment, it's the type of project where you'd want to run detailed cashflow and exit scenarios: service charges, expected rental yields, and potential resale premiums versus non-branded Dubai Marina / Emaar Beachfront stock. That's exactly the kind of modeling you can build using a structured approach like the Cashflow Blueprint you might have seen on Totality Real Estate.

For more on how to compare property managers and long-term running costs (which matter a lot in branded residences), you can also look at this deep dive.

Palm & Harbour branded residences: quick side-by-side

Project | Micro-location | Brand flavour | Density & feel | Typical buyer intent |

Bvlgari Residences, Jumeirah Bay | Private island just off Jumeirah | Understated, ultra-private, resort-like | Extremely low density, villas + low-rise | Capital preservation + privacy; personal use first |

The Royal Atlantis Residences | Palm Jumeirah crescent | High-theatre resort, iconic architecture | Large integrated resort community | Trophy home + lifestyle; some rental play |

Dorchester: One at Palm | Palm trunk waterfront | Quiet ultra-luxury | 94 residences only, very private | Primary or second home; long hold |

Six Senses Residences The Palm | Palm Jumeirah | Wellness-first, retreat-style | Resort + branded residences | Retreat + longevity; semi-end use |

Dubai Harbour waterfront | Energetic, design-led, active lifestyle | 3-tower complex with big podium | Younger UHNW / affluent; mix of use + investment |

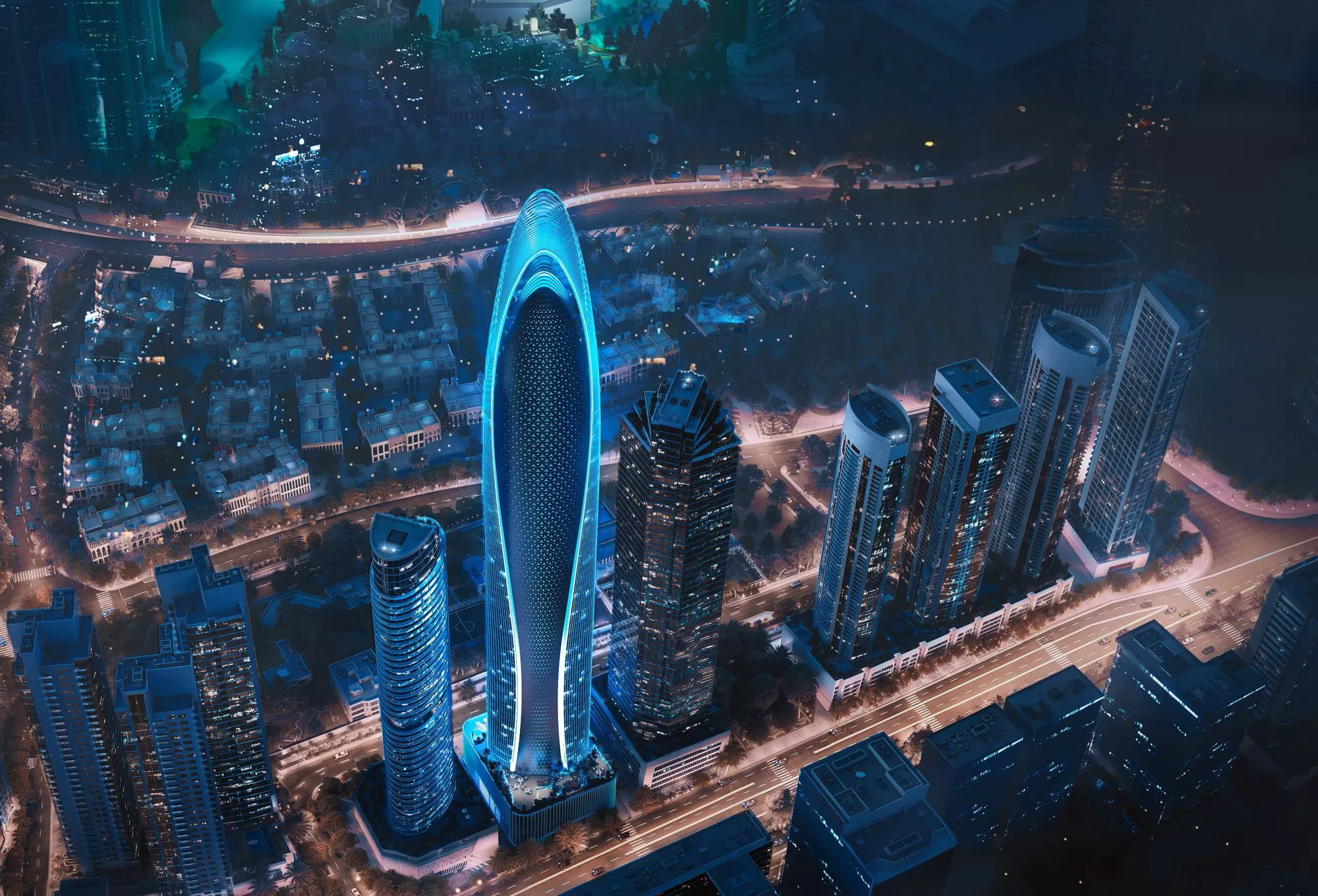

Bugatti Residences by Binghatti: hypercar living in Business Bay

If Bvlgari is about quiet island seclusion and Royal Atlantis is about resort theatre, Bugatti Residences by Binghatti is… well, something else entirely.

It’s the first Bugatti-branded residential project in the world, set in Business Bay, with a flowing, wave-like façade inspired by the French Riviera and Dubai’s dunes. The development combines 2–4 bedroom “mansions in the sky” across two towers, grouped into the Riviera Mansion Collection and the ultra-rare Sky Mansion Penthouses.

A few elements sum up the concept:

-

Car-to-penthouse living

Private car lifts allow certain penthouses to bring your car directly to your residence level.

It sounds gimmicky until you picture the target buyer: serious car collectors who actually enjoy the idea of their Bugatti being part of the interior composition, not parked in a basement. -

Riviera-in-the-city podium

The podium level is designed as a Riviera-style “beach” with a lagoon pool, palms, and sunbeds, essentially a private artificial shoreline overlooking the city. -

Extreme ticket sizes

Marketing material and broker data suggest starting prices in the high teens (AED millions) for smaller Riviera mansions, with Sky Mansions stretching into nine-figure AED territory.

W Residences Dubai – Downtown (Business Bay edge) by Dar Global

You also asked to include W Residences Dubai – Downtown by Dar Global (Dar Al Arkan), which sits right on the edge of Business Bay and Downtown. Think of it as the more vertical, city-facing cousin to W Residences Dubai Harbour.

This is a 50-storey standalone W-branded tower with around 384 residences mostly 1–3 bedroom apartments with only 8–9 units per floor and a completion target around December 2025.

Key points that matter for a serious buyer:

Location logic

- The tower is positioned so that many units frame direct views of Burj Khalifa and Dubai Fountain, while still plugging into Business Bay’s road network and canal-side lifestyle. It’s more “urban skyline” than “beachfront postcard”.

- As with W Harbour, the tone is energetic and design-led:

- VIP lounge and clubhouse

- Cinema room

- Co-working space

- Infinity pool, landscaped decks, fitness and spa facilities

Where does it sit in the branded-residences spectrum? Probably here:

If you’re a frequent business traveller who spends half your time in DIFC, Downtown or Business Bay, W Downtown is the more natural fit: you’re buying address and vertical lifestyle. If you see Dubai more as a winter beachfront base, W Harbour may match your mental picture better.

For both, it’s smart to run a line-item cashflow and long-term service-charge projection, which is exactly the kind of exercise that tools like Totality’s Cashflow Blueprint are built for, and to compare the branded tower against non-branded towers within a 1-2 km radius before you lock in.

Other notable branded residences you should know about

Not every buyer wants a Palm or Business Bay address. Some prefer quieter creeks, or a bridge between old and new Dubai. Others want villas rather than towers. This is where the “other notable mentions” come in.

The Ritz-Carlton Residences, Dubai Creekside

The Ritz-Carlton Residences, Dubai Creekside sits on a large gated plot (around 80,000 sqm) fronting Dubai Creek, right beside the Ras Al Khor Wildlife Sanctuary.

A few things stand out:

- Roughly 550 meters of private waterfront, positioned so you get long, calm creek views rather than the more dramatic open sea of the Palm.

- A wellness-led concept with spa, medical and health-focused facilities layered into the development.

- Plans for private moorings for yachts up to around 120 ft, which is a subtle but important detail for some buyers.

This is not the Dubai of tourist brochures. It’s slower, greener, and feels slightly removed from the pace of Downtown while still being roughly a 15 minute drive from Burj Khalifa.

If you like the idea of branded waterfront living but find Palm Jumeirah a bit too busy, Creekside is worth exploring.

One&Only Private Homes at One Za’abeel

If there’s one project that physically symbolizes “Old Dubai meets New Dubai”, it’s One Za’abeel. Two tall towers straddling a major highway, linked by The Link, a record-breaking cantilevered sky bridge with restaurants and experiences suspended high above the city.

Within that complex sit the One&Only Private Homes, a collection of branded residences serviced by One&Only.

Highlights:

- Central location between DIFC, World Trade Centre and old Dubai

- Access to One&Only’s hospitality ecosystem—dining, spa, sky-bridge venues

- Contemporary interiors with a subtler aesthetic than some of the flashier beachfront projects

One Za’abeel tends to appeal to:

- Senior executives and entrepreneurs who want quick access to both business hubs and the airport

- Buyers who love architectural “statement pieces” but still want a strong operator behind the scenes

Mercedes-Benz Places by Binghatti, Downtown Dubai

If Bugatti Residences is the flamboyant hypercar cousin, Mercedes-Benz Places by Binghatti is the calm, tech-forward sibling.

This 65-storey tower in Downtown Dubai is marketed as the world’s first Mercedes-Benz branded residence, blending automotive design cues sleek, aerodynamic lines with a focus on intelligent, connected living.

Key aspects:

- Height & presence

The tower is set to rise to around 341 metres, placing it firmly in Dubai’s “super-tall” cluster near Burj Khalifa. - Unit mix

A premium collection of 2, 3, and 4-bedroom apartments and penthouses, many with private pools, pitched at buyers who like the idea of “smart luxury” rather than overt opulence. - Concept

Marketing materials talk a lot about emotion, intelligence and precision the same values Mercedes-Benz uses in its cars translated into lighting, materials, and integrated technology in the homes themselves.

This is a natural fit for someone who spends serious time in Downtown, loves the brand, and cares about design language and smart-home features as much as the view.

Karl Lagerfeld Villas, Meydan / MBR City

Finally, not everyone wants a tower.

Karl Lagerfeld Villas in Meydan (MBR City) answer a different brief: branded, fashion-led 5-7 bedroom villas with private pools in a gated, low-density environment.

Why they’re interesting:

- It’s the Middle East’s first Karl Lagerfeld branded residential development, with only around 51 villas in total.

- Villas range from roughly 722-1,790 sqm of built-up area, with layouts clearly pitched at large families and serious entertainers.

- The aesthetic blends Parisian-inspired design with modern Dubai architecture-think bold lines, fashion-house detailing, and a lot of glass.

Location-wise, MBR City / Meydan gives you a more residential, villa-community feeling but still keeps you within a short drive of Downtown and key schools-making this more of a primary residence or long-stay family base than a lock-up-and-leave pied-à-terre. You might also want to keep an eye on Mercedes-Benz City in Meydan and Waldorf Astoria Residences on Dubai Islands, which sit slightly earlier on the curve but are important pieces of Dubai’s next wave of branded stock. Mercedes-Benz City is a Dh30 billion ($8.2 billion), master planned, 10 million sqft branded district in Meydan, built around a collection of synchronized Mercedes-Benz residential towers, retail boulevards, parks and mobility hubs, essentially a city within a city for owners who like the idea of living inside a coherent, design led ecosystem rather than a standalone tower. On the opposite side of town, Waldorf Astoria Residences Dubai Islands will introduce around 120 ultra luxury branded homes anchored to a new Waldorf Astoria resort, giving owners fully furnished residences with direct access to hotel level services, curated dining and a quieter, resort style waterfront setting on Dubai Islands rather than the more intense pace of Downtown or the Palm.

You might also want to keep an eye on Mercedes-Benz City in Meydan and Waldorf Astoria Residences on Dubai Islands, which sit slightly earlier on the curve but are important pieces of Dubai’s next wave of branded stock. Mercedes-Benz City is a Dh30 billion ($8.2 billion), master planned, 10 million sqft branded district in Meydan, built around a collection of synchronized Mercedes-Benz residential towers, retail boulevards, parks and mobility hubs, essentially a city within a city for owners who like the idea of living inside a coherent, design led ecosystem rather than a standalone tower. On the opposite side of town, Waldorf Astoria Residences Dubai Islands will introduce around 120 ultra luxury branded homes anchored to a new Waldorf Astoria resort, giving owners fully furnished residences with direct access to hotel level services, curated dining and a quieter, resort style waterfront setting on Dubai Islands rather than the more intense pace of Downtown or the Palm.

Who should buy what? Matching brands to buyer profiles

At this point, it’s easy to feel slightly overwhelmed. Everything looks good in glossy renders. So a more human question is: who actually belongs where?

A few rough archetypes:

The discreet capital preserver

Likely fit: Bvlgari Residences, One at Palm Jumeirah, ORLA / ORLA Infinity, Ritz-Carlton Creekside

Priorities: privacy, limited supply, quiet lobbies, predictable long-term value

Yield is secondary; the “sleep at night” factor is primary.

The resort-and-views chaser

Likely fit: The Royal Atlantis Residences, Six Senses The Palm, W Harbour

Priorities: sea, skyline, resort amenities, something to show visiting friends and family

Okay with a bit more tourism energy in exchange for facilities and views.

The city hub power user

Likely fit: Armani Residences, W Downtown, One&Only One Za’abeel, Mercedes-Benz Places

Priorities: being minutes from meetings, DIFC, Downtown dining, Dubai Mall

Views matter, but so do drive times and access routes.

The statement collector

Likely fit: Bugatti Residences, Karl Lagerfeld Villas, some of the larger ORLA or Royal Atlantis penthouses

Priorities: uniqueness, brand story, design drama, often multiple homes across the globe

Less concerned with spreadsheets, more with owning something nobody else on their street has.

From a pure yield perspective, most branded residences will sit below the classic “investor workhorse” communities (JVC, some zones of Dubai South, parts of Dubailand, etc.), which can often produce stronger gross percentages but without the same cachet or lifestyle package. If maximizing yield is your first priority, a data-led guide like Most affordable areas to buy in Dubai (prices, psf, yields) is a better starting point than this article.

How to evaluate a branded residence before you commit

Whether you’re eyeing a W, a Six Senses, or a Bugatti Sky Mansion, a few practical checks are worth doing before you sign anything:

Service charges per sq ft

Get current or projected service charges in writing, including what’s bundled (chiller, brand fee, common-area maintenance, etc.).

Then re-run your net yield after those costs.

Brand & operator agreement

Clarify how long the brand agreement runs and what happens if it is not renewed.

Ask who is actually operating day-to-day services (hotel operator vs separate management firm).

Developer track record

For off-plan, look at delivery timelines and build quality on the developer’s previous projects.

Cross-check with a third-party advisor, not just glossy brochures.

Resale liquidity

Ask how many resale transactions have actually closed in that building (or similar branded stock) and at what discounts/premiums versus asking prices.

Trophy stock is fantastic… until you need to sell quickly into a small buyer pool.

Property management

If you plan to rent the unit short or long term understand who will manage it and on what terms. Misaligned management can quietly erode your returns over time.

For a deep dive on what to look for in a property manager and how to compare them, this guide helps.

Compare with a non-branded neighbor

Always compare at least one non-branded building in the same micro-location.

If the branded premium feels too extreme for the benefits offered, you may be paying more for marketing than for enduring value.

Frequently Asked Questions

1. Do these luxury branded residences qualify me for a Dubai Golden Visa?

Short answer: In most cases, yes if your total property value is AED 2 million or more and you meet the standard Golden Visa criteria.

In practice, that means a single residence in places like Bvlgari Residences, Royal Atlantis, Six Senses, W Residences Harbour / Downtown, Bugatti, Mercedes-Benz Places, or Ritz-Carlton Creek will almost always cross the AED 2M threshold. Even if you’re buying a smaller unit, you can combine multiple properties to reach the minimum, as long as the combined value is at least AED 2M and they’re registered in your name.

Off-plan units can also qualify, but there are extra conditions: you typically need a valid Sales & Purchase Agreement (SPA), proof of payments, and sometimes a developer or bank letter confirming value and progress. Rules evolve over time, so it’s wise to sanity-check requirements with Dubai Land Department (DLD) or a specialist before you sign.

2. Can foreigners own these branded residences outright, or are there restrictions?

Most of the developments mentioned Palm Jumeirah, Jumeirah Bay, Business Bay, Downtown, Dubai Harbour, Dubai Creekside, Meydan/MBR City sit within Dubai’s designated freehold zones, where foreign buyers can own property outright in their own name or via approved structures (like certain companies or foundations).

What sometimes confuses people is not ownership, but usage rules: some branded residences are integrated with hotels and may have guidelines on short-term rentals, branding of listings, or fit-out changes. Others (like Bvlgari or One at Palm) feel more like pure residences, with full freehold ownership and “normal” owners’ association rules.

So yes, foreigners can own these homes; the real nuance is how you’re allowed to use them, not whether you’re allowed to own them.

3. How much higher are service charges in branded residences compared with normal luxury buildings?

It varies by project, but it’s common to see branded ultra-luxury buildings in Dubai sitting in the mid-20s to 40+ AED per sq ft per year for service charges, sometimes more for extremely service-heavy or resort-like concepts. That’s higher than many “standard” luxury towers but in line with hotel-serviced product globally.

What you’re paying for isn’t just cleaning the lobby. Typical inclusions in places like Royal Atlantis, Six Senses, W, or Bugatti might be:

- 24/7 concierge and valet

- Heavily staffed security

- Hotel-style housekeeping options (even if chargeable per use)

- Large landscaped podiums, lap pools, spa facilities, gyms, kids’ areas

- Brand-management fees and a higher design/maintenance standard of common areas

The smart move is to get the latest service-charge schedule in writing and then re-run your projected net yield with those numbers baked in. A 6% gross can quietly become 3-4% net once you layer in service charges, utilities, and management.

4. Can I list my branded residence on Airbnb or Booking.com?

This is one of the most common questions, and the answer is: it depends very heavily on the building.

Some branded residences especially those tightly integrated with a hotel, like parts of Atlantis, Six Senses, or certain Downtown concepts may have:

- Restrictions on short-term lets (to protect brand standards)

- Requirements to use an approved rental pool or operator

- Specific rules on how the property is marketed (photos, logo use, naming)

Others, especially pure residential schemes like Karl Lagerfeld Villas or some Palm/Bay towers, can be more flexible, as long as you comply with Dubai’s DTCM short-term rental regulations, building bylaws, and get the correct permits and management in place.

If you’re buying with a short-stay strategy in mind, make this a pre-contract question, not an afterthought. Get written clarity from the developer or building management about:

- Whether short-term rentals are allowed

- Which types of operators you can use

- Any profit-sharing or branding constraints

5. Are luxury branded residences better for capital appreciation or for rental yields?

In broad strokes, Dubai’s branded residences tend to be capital-appreciation and capital-preservation plays first, and yield plays second.

Because you’re paying a premium for:

- An international brand (Bvlgari, Bugatti, W, Ritz-Carlton, Six Senses, etc.)

- A prime waterfront/skyline micro-location

- A high-touch service layer

…yields often sit below what you could achieve in well-chosen mid-market communities (JVC, parts of Dubai South, some sections of Dubailand), which can offer higher gross percentages on a lower ticket.

Where branded residences shine is when:

- The brand is strong and scarce (first Bugatti tower, ultra-prime Bvlgari island, limited Dorchester stock)

- The location is irreplaceable (Jumeirah Bay, best Palm crescent plots, true Downtown view corridors)

- The building becomes a “name” in global luxury circles

In that scenario, you’re less focused on a couple of percentage points of yield and more on owning something that will still feel special and liquid ten years from now.

6. How risky is it to buy these branded residences off-plan compared with buying ready?

Off-plan always carries extra layers of risk delays, design changes, market cycles but with branded residences you also have brand and execution risk:

- Will the finished lobby, spa, and amenities actually feel like the renderings?

- Will the hotel/operator really run the building at the promised standard?

- Could the brand partnership change midway?

That’s why, for off-plan projects like W Residences Harbour, Mercedes-Benz Places, Bugatti Residences, Karl Lagerfeld Villas and other under-construction schemes, it’s crucial to:

- Check the developer’s track record on previous projects.

- Look for escrow-protected payment plans and DLD registration.

- Understand the brand agreement length and what happens if it’s ever terminated or not renewed.

Buying ready stock in places like Armani Residences, One at Palm, some resales in Royal Atlantis or Bvlgari reduces build risk, but you’ll usually pay a higher upfront price and you miss any upside from early off-plan pricing.

7. How does property management usually work in these branded residences? Can I appoint my own manager?

There are three common models:

-

Fully in-house / brand-aligned management

-

The operator (e.g. Ritz-Carlton, Six Senses, One&Only) or a sister entity manages the building and may offer optional in-unit services.

-

For short-term rentals, you might be required to use approved operators or a central pool.

-

-

Developer-appointed management plus brand oversight

-

A third-party building management firm handles day-to-day operations under brand standards.

-

Owners can sometimes choose their own long-let manager as long as they respect building rules.

-

-

More flexible residential management

-

In villa communities like Karl Lagerfeld Villas or in some predominantly residential towers, you can often appoint your own long-term rental manager and just pay normal service charges to the building/owners’ association.

-

The important thing is to separate two layers in your mind:

-

Building / community management (common areas, security, facilities)

-

Unit-level management (marketing, tenant sourcing, cleaning, check-in/out)

Tier-one property managers in Dubai are used to working inside branded buildings, but the allowed level of customization really varies by project.

8. How private and secure are these branded residences compared with normal towers?

Generally, privacy and security are a big part of the value proposition.

In places like Bvlgari Residences, One at Palm, ORLA, Royal Atlantis, Bugatti, W Harbour, you’ll typically see:

- Multiple controlled access points (gatehouses, reception security, lift key-cards)

- Separate drop-offs or cores for residents vs hotel guests

- Discreet visitor registration and valet

- More staff per unit than in a non-branded building

Jumeirah Bay, for example, is already a gated island; add Bvlgari’s extra layer of security and you get a community where random foot traffic simply does not exist. On the other hand, a very hotel-integrated property with a famous rooftop or sky pool may have more general visitors moving through certain zones so the design has to ensure residents still have private elevators, lobbies and amenities.

If privacy is a top priority, it’s worth walking the building (or a comparable completed project by the same brand) at different times of day just to feel the flow of people: mornings, late evenings, weekends.

9. What happens if the brand or operator changes in the future? Does that kill the value?

This is a slightly uncomfortable question, but it’s realistic and sophisticated buyers do ask it.

Most branded residence agreements are medium to long-term management contracts between the developer/owners’ association and the brand/operator. The exact length and renewal clauses vary and are usually not printed on the sales brochure. In some cases, a brand can be re-negotiated, re-licensed, or even switched if both parties agree or if certain performance conditions aren’t met.

If a top-tier brand like Bvlgari, Ritz-Carlton, Six Senses, W, One&Only, Mercedes-Benz were ever to step away from a building, the value impact would depend on:

- How strong the underlying real estate is (location, views, layouts)

- Whether another credible brand or operator steps in

- Whether the building has already established its own independent reputation

In other words, a best-plot Palm or Jumeirah Bay building with excellent architecture may still hold strong value even if the brand layer changes in 15–20 years. But if the brand was doing most of the heavy lifting (average location, average design, famous name), then a change could matter more.

This is another reason to favor projects where both the brand and the real estate are exceptional.

10. How do I choose between Palm Jumeirah, Jumeirah Bay, Business Bay, Dubai Harbour, Creekside, or Meydan for a branded residence?

A simple way to make the decision less abstract is to ask yourself four questions:

-

Where will I actually spend my time?

-

If it’s mostly beach clubs, marinas and sea-facing brunches → Palm Jumeirah, Dubai Harbour, Jumeirah Bay.

-

If it’s meetings, DIFC, Dubai Mall, business dinners → Downtown / Business Bay / One Za’abeel / Mercedes-Benz Places / W Downtown / Armani.

-

-

Do I want a resort or a city feel?

-

Resort: Royal Atlantis, Six Senses, W Harbour, Bvlgari, ORLA, Ritz-Carlton Creek.

-

City: Armani, W Downtown, Mercedes-Benz Places, One Za’abeel, Bugatti.

-

-

Tower or villa?

-

Tower: most projects on Palm, Harbour, Business Bay, Downtown.

-

Villa: Karl Lagerfeld Villas (Meydan/MBR City), plus select ultra-prime villas in other branded schemes.

-

-

Am I optimizing for lifestyle, legacy, or yield?

-

Lifestyle: almost any of the above, but pick the one where you genuinely see yourself using the facilities.

-

Legacy / capital preservation: Bvlgari, One at Palm, ORLA, Royal Atlantis, Bugatti, Mercedes-Benz Places on stronger plots.

-

Yield: you might still invest in branded stock, but you’ll compare it carefully against non-branded, high-yield communities before deciding.

-

Once you’ve answered those honestly, you’ll usually find the list narrows down to two or three projects, not ten. That’s the point where a detailed, numbers-based comparison and ideally a couple of site visits will tip the balance.

Conclusion: When a “nice address” becomes a serious asset

If you’ve read this far, you’re probably not just window-shopping.

You’re weighing something more important: Where do I park meaningful capital in Dubai in a way that still feels like an upgrade to my life?

Luxury branded residences sit exactly at that intersection.

They’re rarely the highest-yield units on the market, and they’re not meant to be. Instead, they combine four things that almost never show up together in one asset:

- A globally recognized brand with real staying power

- An ultra-prime micro-location (island, harbour, skyline, creek, or gated villas)

- A curated lifestyle you will actually use service, wellness, privacy, community

- A level of scarcity that makes the story easier to tell when you eventually sell

Bvlgari on Jumeirah Bay, Royal Atlantis on the Palm, W in Dubai Harbour or Downtown, Bugatti in Business Bay, Six Senses, Ritz-Carlton Creek, Mercedes-Benz Places, Karl Lagerfeld Villas… on paper they’re names; in reality, they’re very different answers to the same question:

“What kind of life do I actually want this property to support?”

Some people will thrive in a quiet, almost hidden island enclave. Others need to see Burj Khalifa every morning. A few want to walk from the boardroom to the sky bar without ever crossing a highway. There is no “best” branded residence in Dubai in absolute terms only the best fit for your capital, your lifestyle, and your exit strategy.

This is where a data-led, brand-agnostic advisor can make a real difference. Someone who will happily tell you not to buy the flashiest tower if the numbers or the exit liquidity do not make sense for you.

Ready to explore the right branded residence for you?

If you’re financially comfortable and you’re now looking for the right opportunity not just the next launch it may be time for a more focused conversation.

At Totality Real Estate, we can help you:

- Shortlist 3-5 projects that actually fit your profile (and filter out the noise).

- Run a clean cashflow model on each option, including service charges and realistic rental scenarios.

- Compare branded vs non-branded stock in the same micro-location, so you can see whether the premium is really justified.

- Coordinate viewings or virtual tours and, when needed, connect you with mortgage and Golden Visa specialists.

If you’d like a curated, numbers-backed view of Dubai’s best luxury branded residences tailored to your budget and goals take the next step:

👉 Visit totalityestates.com and request a private branded-residence consultation

One good conversation, with the right data in front of you, is often all it takes to go from “I like the look of these towers” to “I know exactly which key I want in my hand.”