Turn capital into cash flow

Data-led off-plan picks, fast financing, and done-for-you operations – so your Dubai portfolio performs from day one

Trade License #1368010 Where investment becomes income

We underwrite off-plan projects for forward yields, secure financing in days, and hand over operate-ready assets-snagged, furnished, listed, and rented. You get clarity, speed, and income from day one.

Underwritten Off-Plan Opportunities

Curated projects with DealScore™ grading, conservative rents, and transparent costs

From capital to cash flow – in three steps

A clear, proven path to income-generating real estate

Blueprint

Budget, leverage, and yield targets analyzed with our Cashflow Blueprint™ tool

Tool Output:

- •2-3 property recommendations

- •Custom financing scenarios

- •Forward yield projections

- •Tax optimization strategies

Blueprint

Budget, leverage, and yield targets analyzed with our Cashflow Blueprint™ tool

Tool Output:

- •2-3 property recommendations

- •Custom financing scenarios

- •Forward yield projections

- •Tax optimization strategies

Acquire

A/B-grade DealScore™ properties with pre-approved financing in days

DealScore™ Includes:

- •A-F grading system

- •Rent comp analysis

- •Risk assessment

- •Financing pre-approval

Operate

Snag, furnish, list, and rent – get your first income payment in 30-45 days

Timeline:

- •Week 1: Snagging

- •Week 2: Furnishing

- •Week 3: Placement

- •Optimized monthly income

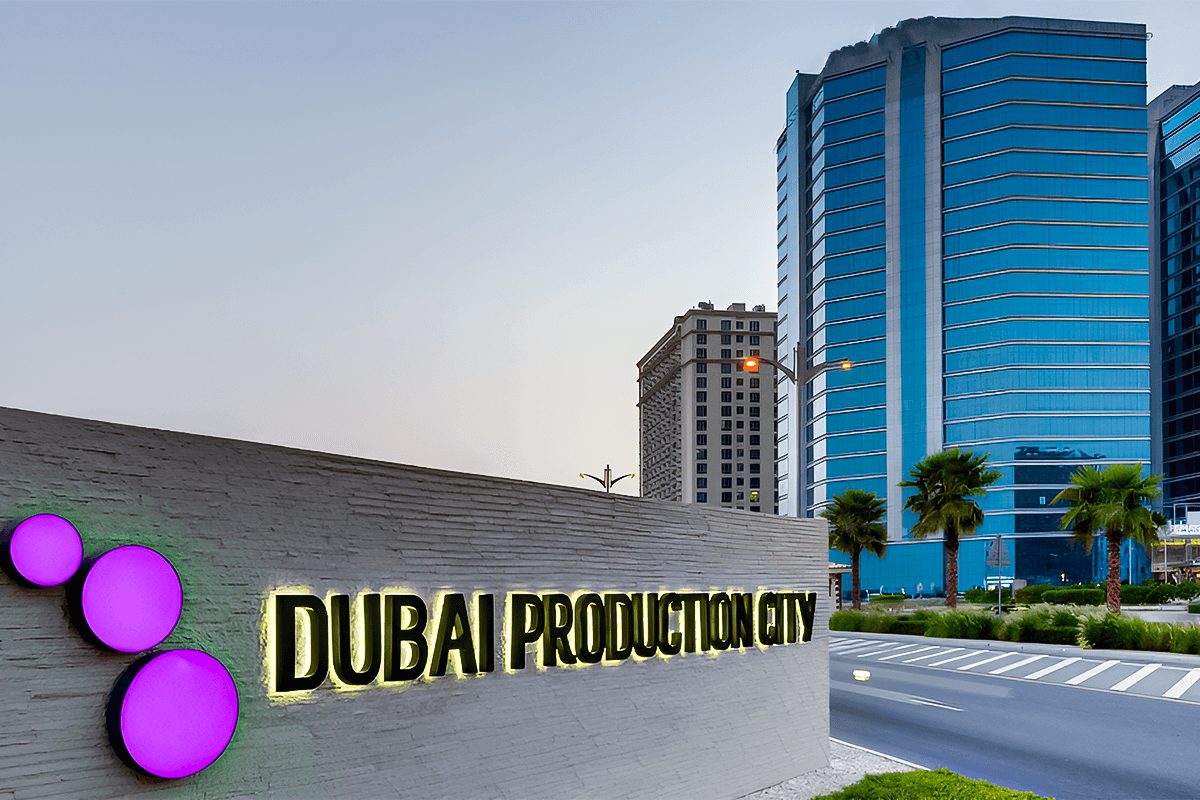

Location Index

Matching you with a community that feels like home and a lifestyle with limitless possibilities.

5 Days Free Tour

Exclusive Access. Limited Seats. Expert Guidance.

*Free tour - conditions apply

Your Investment Partner in Dubai

Your Investment Partner in Dubai

Since 2006, I've helped investors achieve exceptional returns through data-driven real estate strategies. Our platform combines cutting-edge tools with personal expertise to ensure your Dubai portfolio performs from day one.

RERA Licensed & Compliant

Full regulatory compliance and transparency

Personal Investment Portfolio

I invest in the same properties I recommend

End-to-End Service

From acquisition to rental income generation

What Our Clients Say

Choose your path

Whether you're ready to invest or just starting your research, we're here to guide you

Frequently Asked Questions

These are some of the most frequently asked questions about properties in Dubai.

Explore all FAQYes, foreigners can buy property in designated freehold areas in Dubai. These areas offer full ownership rights and long-term residency options.

Dubai Investment Blog

Explore our Dubai Property Blog

Why Are Billionaires Moving to Dubai?

Best Off Plan Projects in Dubai to Buy in 2026, High Probability Upside Plays Toward Doubling by 2030

Buy Property in Dubai, A Practical Step-by-Step Guide for Foreign Buyers

Why My Dubai Property Is Not Selling, The Real Problem Nobody Says Out Loud

Thinking About Azizi Riviera? The Complete Community Guide, And the Hidden Resale Problem Owners Don’t See